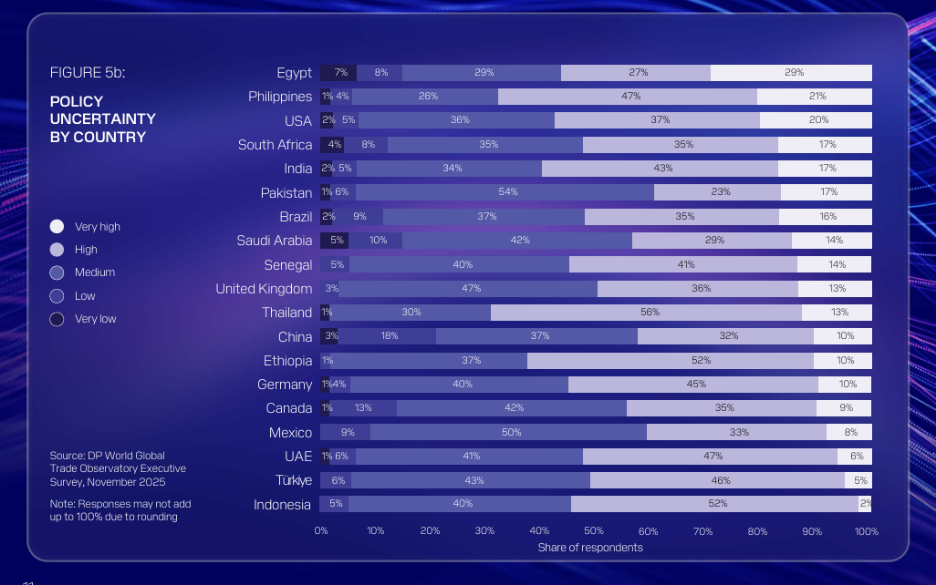

More than half of supply chain executives expect policy uncertainty to remain high in 2026 as businesses brace for more geopolitical instability and higher costs, a DP World survey has shown.

Research among 3,500 senior supply chain and logistics executives across global industries, published amid the World Economic Forum annual meeting in Davos this week, found that 53% of respondents anticipate ‘high’ or ‘very high’ policy uncertainty.

Meanwhile, nine in 10 business leaders expect trade barriers to either rise (47%) or remain unchanged (43%) in 2026. Half also forecast “moderate or sharp” cost increases across shipping and transport, labour, and customs and compliance.

DP World’s findings, part of its Global Trade Observatory annual outlook report, were compiled before US President Donald Trump further shook up global stability this week by threatening additional tariffs on some European countries amid the ongoing dispute over Greenland.

Trump, who is set to speak at the Davos conference today, said the US could impose tariffs of 10% on goods from Denmark, the UK, Germany, Norway, Sweden, France, the Netherlands and Finland on February 1 – rising to 25% in June –, unless “a deal is reached for the complete and total purchase of Greenland”.

The survey results also come amid warnings from the UN Trade and Development (UNCTAD) in its January global trade update, which said governments are “expected to continue using tariffs as protectionist and strategic tools” in 2026, and that “uncertainty is likely to persist”.

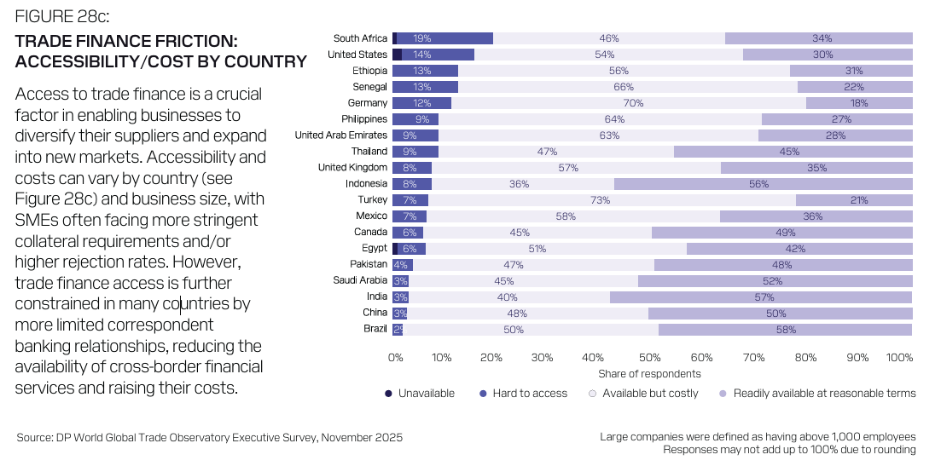

Meanwhile, trade finance also emerged as one of executives’ priority concerns in DP World’s survey, with 53% of respondents finding it too costly, while 8% said access was difficult.

This issue was particularly problematic for SMEs, with only 35% of executives from smaller companies reporting that they could readily access finance on reasonable terms, compared with 50% at large companies.

“Accessibility and costs can vary by country and business size, with SMEs often facing more stringent collateral requirements and/or higher rejection rates,” DP World’s survey pointed out.

“Trade finance access is further constrained in many countries by more limited correspondent banking relationships, reducing the availability of cross-border financial services and raising their costs.”

Nevertheless, overall business confidence remained steady despite the geopolitical risks and financial strains, the survey found.

Only 25% of executives expect incoming trade barriers to have a negative impact on their business, with 49% expecting no effect and 26% even seeing a positive impact.

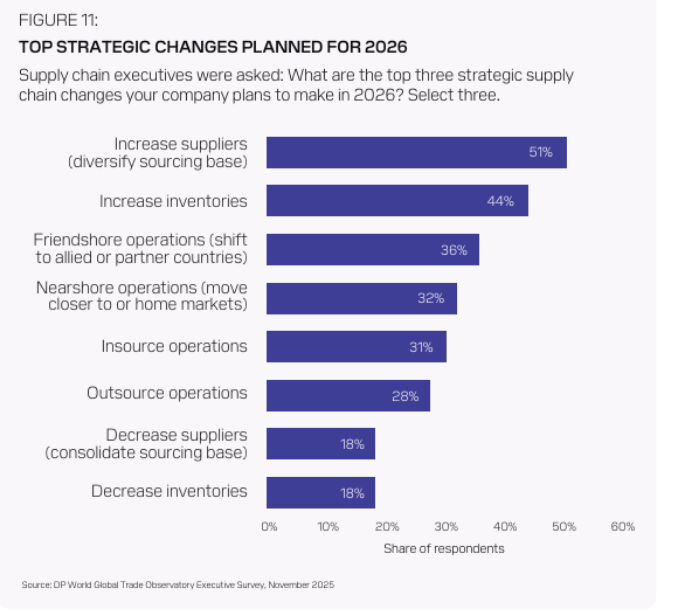

In light of the uncertainty, the survey’s respondents cited supplier diversification (51%), higher inventories (44%) and friend-shoring (36%) among the most common strategic shifts planned for 2026.

Additionally, 26% said they intended to use new routes, while 23% said they were evaluating them.

Supply chain leaders are also set to prioritise investment in warehousing and logistics hubs (39%), road networks (36%) and border/customs processing infrastructure (36%).

“What we’re seeing is confidence with contingency plans,” said Margareta Drzeniek, managing partner at Geneva-based insights agency Horizon Group, which helped develop DP World’s survey.

“Executives are embedding resilience into strategy by diversifying suppliers, reassessing routes and adding options, because volatility is now the baseline. Those best positioned will be the ones who can turn those resilience plans into measurable performance.”

Meanwhile, more than half of supply chain executives (54%) expect growth this year to be faster than in 2025, while 40% expect it to be in line with last year’s levels.

India and the US recorded the highest shares of respondents anticipating faster trade growth in 2026 compared to 2025, at 79% and 76%, respectively. While the former has boosted exports through new free trade agreements, the latter has seen initial tariff shocks ease and looser monetary conditions support trade finance.

They were followed by Saudi Arabia (70%) and the UAE (64%), where infrastructure investments are boosting trade volumes, and Thailand (73%), where “new trade agreements and foreign direct investment inflows are supporting manufacturing exports”, the research showed.

Europe and China were identified as the top regions for trade growth in 2026. Additionally, technology, consumer goods and industrials were forecast to be the primary drivers of expansion globally.

This practitioner-led sentiment contrasts with wider macroeconomic projections – UNCTAD’s latest update showed trade growth is expected to remain positive in 2026, but that “the pace will slow”.