Patrick DeVilbiss, CGI’s head of product for trade and supply chain finance, unpacks the findings of the latest CGI-Baft survey, revealing how shifting revenue models, mounting compliance pressures and the drive for digital transformation are reshaping the future of trade finance.

As trade finance continues to evolve, the findings from the latest CGI and Baft (Bankers Association for Finance and Trade) ‘Global trade technology industry survey’ reveal seismic shifts that will shape the industry’s future. With declining revenue from traditional trade services, rising regulatory pressure and an urgent need for digital transformation, trade banks are being forced to rethink their strategies.

Here’s a breakdown of the key insights and what they mean for the global banking ecosystem.

The shifting revenue landscape

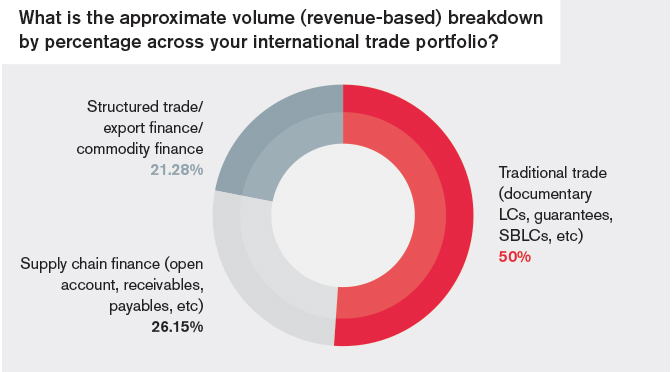

For the first time, traditional trade services account for less than half of expected bank revenues in the near term. According to the survey, revenues from core trade services have dropped below 50%, with projections dipping further to 39% over a five-year horizon. Meanwhile, open account trade is expected to climb to 32%, and structured trade finance is projected to rise to 26%.

This marks a significant departure from past norms and reflects the long-predicted rise of open account services and more complex financing structures. Compared to 2021 data, open account revenue has seen a 25% increase and now accounts for a quarter of bank revenue. These findings underscore a structural realignment in the industry, as simpler trade finance products give way to more customised and risk-sensitive offerings.

Regulatory and compliance pressure mounts

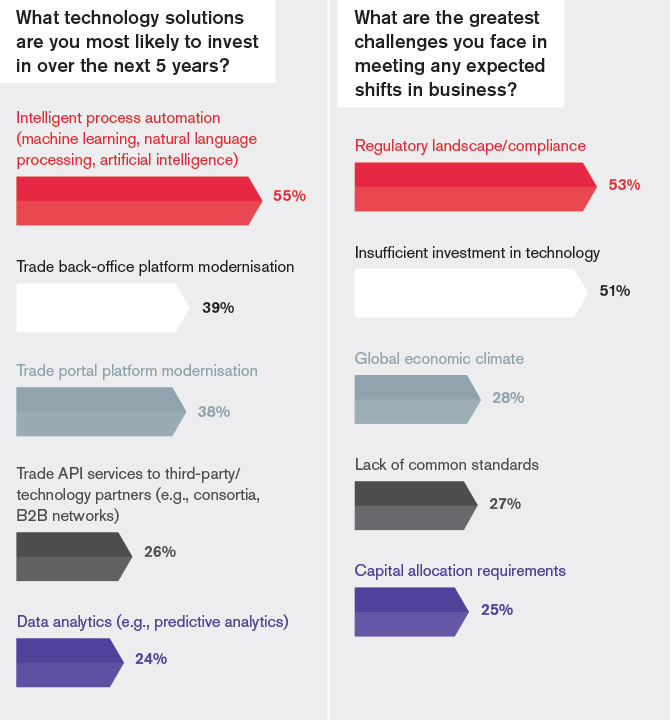

Another notable shift in this year’s survey is the elevation of regulatory compliance as the top challenge banks face, overtaking even technological investment. This change reflects the increasingly complex geopolitical and regulatory environment that trade banks must navigate.

From sanctions and tariffs to transshipment restrictions and military conflicts, banks are now contending with a fragmented global regulatory matrix. Differing national regulations, retaliatory trade policies and diminishing faith in multilateral governance all suggest a more fractured and volatile trade landscape for the foreseeable future.

As banks operate across multiple jurisdictions, the need for agile, responsive compliance infrastructure has never been more acute. These regulatory and compliance expectations are further exacerbating limited investment dollars and forcing banks to make very difficult decisions about how they spend money and internal resources.

The push for modernisation

Despite macroeconomic uncertainty, banks are doubling down on modernisation, particularly in their front and back-office systems. The survey shows that 39% of banks are targeting back-office upgrades, up from 36% the previous year. More striking is the 11-point jump in front-office modernisation, now a priority for 38% of respondents.

This trend is driven by rising client expectations, pressure from fintech entrants and the demand for more agile, integrated systems. Dated platforms pose significant barriers to efficiency and innovation. To stay competitive, banks must streamline their operations and adopt a digital infrastructure capable of supporting evolving global trade ecosystems. Combined with the regulatory and compliance landscape, this requires banks to explore solutions that drive reduced ownership costs while offering advanced capabilities and ongoing enhancements such as those offered by Software as a Service models.

There is also an increased interest in intelligent process automation (IPA) solutions, a blend of machine learning, artificial intelligence and operations workflows. Alone, IPA solutions allow for banks’ operations staff to focus on more value-add tasks while potentially attracting new entrants into the trade workforce. When combined with more modern systems, significant efficiency gains and better customer service are possible.

Balancing investment with uncertainty

While the need for modernisation is clear, economic and political uncertainties continue to dampen major investment initiatives. Enterprise-level caution often means that even strategically vital businesses like trade finance struggle to secure transformational funding.

This contradiction of high strategic importance, yet under investment, risks leaving banks behind. In an increasingly uncertain world, risk mitigants like trade finance are critical corporate products and institutions must align their investment priorities with market realities. Failing to do so could hinder their ability to meet rising client demands or capitalise on new trade opportunities.

Banks that are able to pivot and modernise are well-positioned to begin picking up more market share while driving down long-term costs through the use of newer automation and AI technologies.

The way forward

The 2025 CGI and Baft survey signals that trade finance is undergoing a fundamental realignment. Revenue models are shifting, compliance burdens are intensifying and the imperative for modernisation is stronger than ever. Trade banks, whether regional players or global giants, must respond with urgency.

This means embracing technological change, enhancing interoperability with partners and modernising operations to reduce costs and improve service delivery. Those who fail to adapt risk being eclipsed by more agile competitors.

Ultimately, the path forward lies in strategic reinvention where resilience, innovation and customer-centricity become the cornerstones of a modern trade finance strategy.

The full CGI-Baft Survey Results will be available at cgi.com/trade.