UAE-based bank Emirates Islamic has launched a fully digital, shariah-compliant supply chain finance solution named Islamic smartSCF.

The digital product, which Emirates Islamic has deemed the ‘first-of-its-kind’, offers working capital and liquidity solutions to businesses through a “completely digital journey”, the bank says.

Corporates can use the web-based platform to onboard their suppliers under the Islamic smartSCF programme, and benefit from extended and enhanced payment terms for their invoices.

Suppliers, in turn, can access liquidity much earlier than the contractual payment terms, along with the advantage of lower profit rates. They also have the flexibility to receive ‘on-demand’ financing tailored to their needs.

The bank says the product offers favourable accounting treatment as it is balance sheet neutral and not classified as finance in the corporate balance sheet.

The “entire process is seamless, with complete digital real-time processing, ensuring an efficient and smooth experience for all parties involved,” the bank says.

The wider smartSCF platform has already been in use by Emirates Islamic’s parent company, Emirates NBD, for a few years. Its interactive dashboard, automated payable process and contactless supplier onboarding tool are just some of the digital functions that help streamline SCF processes for both suppliers and buyers.

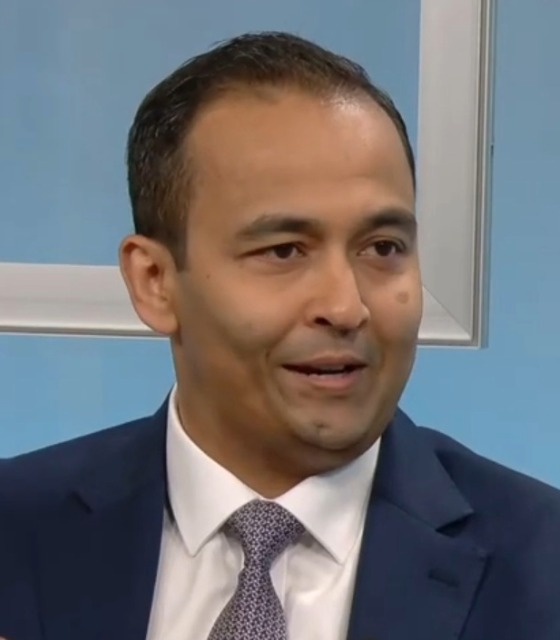

Emirates Islamic’s version is a “shariah-compliant solution for supply chain finance”, says Emirates Islamic CEO Farid Al Mulla, which helps “redefine the way businesses manage their working capital” in the region.

“This solution underscores the bank’s commitment to advancing Islamic finance beyond traditional markets,” Mulla adds.

“As a pioneer in the Islamic finance sector, we are proud to align with national objectives of transforming the UAE into [a] competitive, sustainable and diversified economy.”

Mohammad Kamran Wajid, deputy CEO at Emirates Islamic, adds: “As businesses change their preference towards alternative financing models that align with ESG principles, Emirates Islamic is setting new industry benchmarks while empowering them with ethical and efficient liquidity solutions.

“Further, the bank’s digital innovation capabilities are a testament to its success in integrating Islamic banking principles with customer needs.”