Fintech company SecureLend has launched what it says is a first-of-its-kind AI platform designed to automate business lending and working capital workflows for banks and other funders.

The new platform uses several large language models (LLMs) to help trade and asset-based finance providers that still rely on manual document handling and credit reviews “that can stretch over several weeks”, said SecureLend founder and CEO Tobias Pfuetze (pictured).

The Delaware-based company’s tool aims to streamline those processes, from borrower communication and document intake to financial statement analysis and credit memo generation.

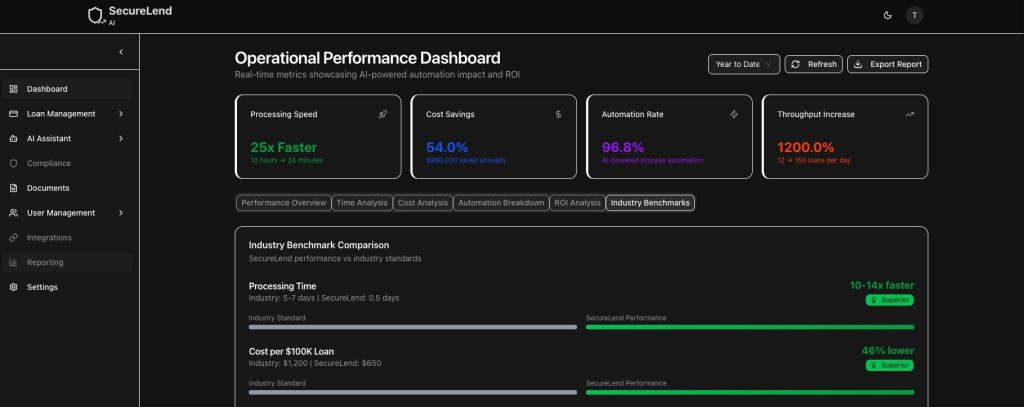

It says this will make loan origination up to 10 times faster and 60% more cost-efficient for community banks, factoring companies and alternative lenders.

SecureLend is currently running private beta pilots in Europe and North America, with broader availability planned for 2026.

The system is being trialled by regional lenders active in factoring, invoice finance and SME working capital facilities, with the goal of reducing credit review time “from weeks to hours”, according to Pfuetze.

Early pilots show 90% faster processing, 67% higher conversion rates, and full automation of borrower communications.

Factoring firms achieved same-day funding, while alternative lenders scaled portfolios without adding staff.

Pfuetze told GTR the technology is designed to give smaller lenders “the same speed and intelligence advantage that online-first competitors enjoy, without locking them into one AI vendor”.

The tool “extends well beyond traditional loan automation”, he added, as the focus is on business funding workflows such as automating document collection (via email and chat), classifying and analysing financial statements, calculating ratios and risk scores from extracted figures, and drafting credit memos for committee review.

All automation is powered or supported by AI. Because SecureLend is “LLM-agnostic”, each user can deploy its own branded application portal and integrate the platform into existing underwriting systems.

The tool allows users to choose between models such as GPT-4, Claude, Gemini, or their own, which Pfuetze said is “a crucial advantage” for regulated lenders who must validate explainability and data residency.

“Community banks are the backbone of local economies, but manual processes can’t compete with digital speed,” Pfuetze said. “We give every bank its own AI lending team that works 24/7 while maintaining compliance and personal touch.”

Pfuetze previously originated assets for Tower Community Bank, Thread Bank , and BroadRiver Asset Management, before switching to the fintech sector – including founding PAYMEY, a European alternative to AliPay and WeChat Pay.

He went on to found SecureLend in 2025, with this new tool being its first product launch.