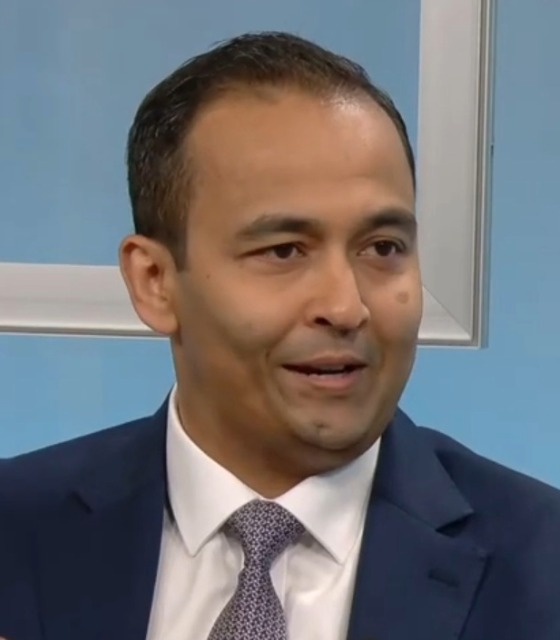

Sriram Muthukrishnan landed at DBS Bank in 2018 after an already impressive trade finance career spanning several years at Standard Chartered, HSBC and ABN Amro.

Having initially joined the Singapore-headquartered bank as head of trade products, Muthukrishnan’s role has since evolved to managing director and group head of transaction banking product management and head of enterprise payments.

In the latest instalment of GTR’s Trade Leaders Interviews series, he talks about his broadened remit and key priorities, how the bank balances its Asia presence with global expansion, and what he’s most proud of having achieved in the past year.

GTR: Your role at DBS has significantly broadened since you joined the bank seven years ago. What has changed, and what are you prioritising now?

Muthukrishnan: I initially joined as the head of trade products, and about two and a half years ago, my role was expanded to include cash management. This gives me a wide playing field and allows me to focus on something I’m passionate about: reducing friction between trade and cash products.

With that in mind, we’ve done capability buildouts, keeping the client at the centre of our product development. In trade, my first job was to complete the entire suite of products for working capital. Typically, banks have strong capabilities in payables and receivables financing, which we developed from the ground up. In Asia, we are now one of the leading banks for these products.

We also developed a suite of inventory finance products, which was timely during Covid and the tariff discussions, as clients were moving from ‘just in time’ to ‘just in case’ inventory models. The timing was perfect, and client interest has been strong.

GTR: What are your priorities going forward?

Muthukrishnan: First, new trade corridors are emerging due to geopolitical shifts. DBS has historically been Asia-centric, but we’re seeing growth from Asia to the Middle East and Asia to Latin America. We’ve built capabilities and partnerships to serve these corridors, including strategic partnerships with First Abu Dhabi Bank and BSF Bank in Saudi Arabia, as well as payment linkages with fintech platforms Nium and Banking Circle.

Second, our trade suite for working capital products is now fully developed and scaling well. Strategic inventory financing is tailored to client requirements, both on- and off-balance sheet. Clients are also concerned about counterparty risk. We now offer the ability to buy entire portfolios, not just individual receivables, which is particularly useful for industries with many small buyers.

These capabilities are moving into the commercialisation stage, with multiple clients already using them.

GTR: How do you balance expanding globally while maintaining a leading presence in Asia?

Muthukrishnan: Strategically, we are an Asia-first bank. We account for more than 70% of the trade flows within Asia through our existing presence. Most capabilities are developed with Asia in mind. Intra-Asia trade itself is growing at a very fast pace, so for us, there is enough to pick up on and continue our growth story, and that’s what we are looking to leverage.

At the same time, a lot of multinational corporates that are coming into Asia are looking for safe partners, such as DBS, to be able to work with in a very volatile geopolitical environment. They want the comfort that, while we serve them in Asia, we can also serve them across corridors. So we have to expand our remit – we look at the Middle East, Latin America and Africa as important growing corridors.

Equally, certain sectors, such as commodities, technology and the financial institutions space, are more global in nature. So we try to look at their holistic global needs and see how we can be part of that. This is where we are trying to expand from being a very Asia-centric bank to also look at areas that are adjacent to, or have a linkage to, Asia.

GTR: Do you have ambitions to increase market share in Asia and become a bigger threat to other global competitors?

Muthukrishnan: Focusing on geographic expansion is not necessarily the model we aspire to. Increasingly, we find that depth and quality are equally important. Our role model is to see how we can make sure that our clients’ needs can be served in an innovative, digital and safe way. And if to do that, we need to have an alliance or stitch together a network of networks, that is what we will do.

Having said that, we’ve started recently expanding our capabilities in countries like Vietnam and Australia.

GTR: What are your priorities in terms of digital trade?

Muthukrishnan: In DBS, we made a philosophical decision early: we will not do proofs of concepts just for the sake of it. We look at scalable solutions. We leverage clients’ flows on multiple platforms, and because we have strong API capability, we plug into multiple platforms to enable client use cases.

From that perspective, what has really worked is a diversified approach. We don’t focus on one platform over another. On the open account side, we have multiple tie-ups, such as with Infor Nexus and CRX, and large clients look to have a single conduit for engaging multiple banks. That strategy has worked very well.

GTR: Given the current geopolitical backdrop, are clients asking you to scale or build certain products?

Muthukrishnan: I think corporates are looking for two things. First, efficiency. In an increasingly volatile world, they want to manage costs as much as possible.

We’ve seen many, especially in commodity trade, trying to move financing requirements onshore into China, where the difference between renminbi financing rates versus US dollar financing rates is meaningful. That’s a big trend.

Second, there’s been a rise in the requirement for structured trade policies such as prepayments. Tenors are now longer; they’re asking for year, year-and-a-half, sometimes two to three-year prepayment financing facilities.

We’ve seen continued demand for receivables financing. In consumer products, we’ve launched a portfolio receivables capability because clients have a long string of distributors and dealers, and they want to know how to manage that.

So basically, certainty and efficiency – if you can bring these to clients, that’s what they value.

GTR: What trade deal or partnership are you most proud of this year? And on the other hand, what’s been your biggest challenge?

Muthukrishnan: I’m proud of the inventory finance capabilities we launched. We did transactions that were fit-for-purpose as clients’ economic environments changed and they needed more strategic reserves and longer cycle times. Pre-shipment finance capabilities were important. The portfolio receivables piece was another highlight: transactions for large consumer products companies covering entire portfolios of buyers, dealers and distributors.

One issue in the trade finance industry is that expertise is being lost, and finding the right talent is a challenge – especially for conventional forms of trade finance. Happily, some young people in my team are showing interest in learning core trade while applying new technologies like blockchain and tokenisation.

GTR: If you could fix one friction in global trade tomorrow, what would it be?

Muthukrishnan: I would fix trade finance digitisation. I’m struck by the fact that we can move large amounts through the payments route quite seamlessly and digitally, but trade still requires a lot of manual intervention. My wish is seamless digital trade flows without compromising anti-money laundering checks and regulatory requirements. We’re making a lot of progress leveraging platforms, APIs, AI and GenAI, but it’s still fragmented.